A Possible Summer Surprise

The monstrous drop I and others have been expecting may be delayed yet-again

I dont ever recall seeing a battery of indicators acting so bizarre, so divergent from one another. Generally, I put out a posting only when things change, and I’ve been watching things change the past several weeks and it’s time. As I always sign out on this blog, “More as conditions develop,” and they have.

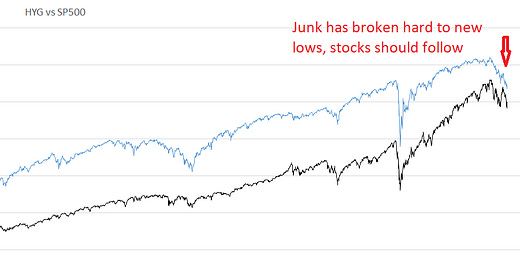

Yes, the market looks like it could collapse …