We must remind ourselves of the current environment, and how precarious things are at the moment.

Beginning with the yield curve, which was inverted for an historically long time, and has now normalized, and what this has meant for the indexes in the past:

But the normalization of the yield curve also sees that period of “extreme vulnerability” we have spoken of in the past here, those periods where more than 90 days have elapsed without as little as 0.32% of total issues being Daily New Lows on NYSE (single digit daily new lows). You can see how almost every major selloff has been in one of thse periods, except for the covid selloff:

I strongly recommend reading the paper on new lows that I wrote with Larry Williams, The Ripple Effect of Daily New Lows, available on the research tab of my website

https://ralphvince.com/research.php

These a are very serious concerns. Frankly, if bond quality spreads were widening quickly, it would be an all out call to hit the bomb shelter for these markets.

We have to remember too, everyone is all-in the equities market, even when 90 day rates got over 5%, everyone stayed in the equities markets! It's not even a zero-interest rates thing anymore, it's just pure wild speculation, and has been for so long now, that no one really even sees it anymore. Look at the proliferation of sports betting — it's a risk-taking pathology, a speculative pathology that has completely taken over the masses. If it was always that easy to make money, how come people weren't always doing it?

Sentiment, long-term, is off-the-charts optimistic in recent months. Yes, there is the rare cat who is just the opposite, but they are in the minority and probably playing it too short-term (more on this later).

Credit markets are bearish, the economy is going nowhere, employment is atrocious and getting worse, and don’t even mention valuations! Technicals are far-worse than people seem to be seeing.

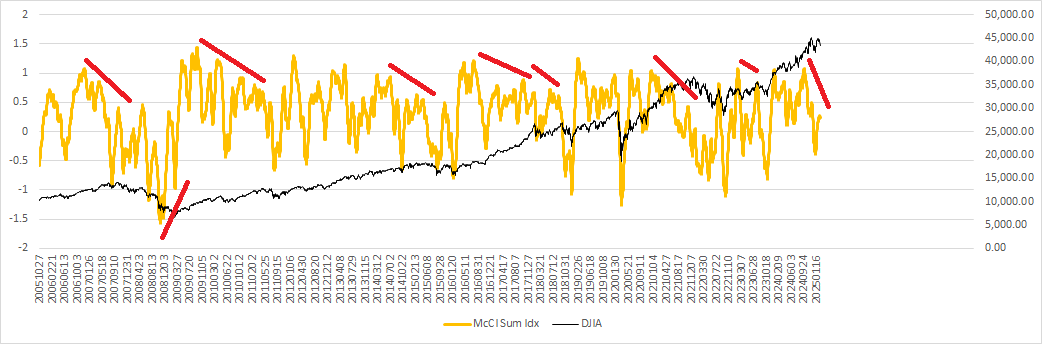

On of the best breadth indicators I am aware of is the McClellan Summation Index. This baby has always given great signals in terms of divergence from what the broad market is doing, and once again, is giving a screaming sell-divergence:

Without going into further depth at the moment, all six pillars that drive equities prices I am clocking as negative here.

Yet, we may be due for a little bounce. We have a volume tunnel buy signal coming up here now, with a close below the Keltner band and a volume bar:

That’s not to say we cannot still have a big, smash day down on 8 or more billion shares and 4% or more new lows. So we don’t actually have the buy signal yet.

Personally, given the backdrop, I think it wise to sidestep this upcoming buy signal.

As you can see in the Vantage Point chart below, the dominant cycle points up into around March 8 from here, and red compression, also in the chart below, at thesee low values telling us to brace for a big, pending move:

But this move could be to the downside. Again, the backdrop is truly reason for extreme caution here.

Why the bears will be wrong too

Ok, I told you before that I think the guys trying to play the downside will be wrong also.