As if on-cue, the S&P 500 advanced yesterday to a new all-time high, as we have been predicting despite the horrific backdrop detailed here over-and-over. Now, however, we are truly in precarious territory as we are about one week into a period of ‘extreme vulnerability” historically.

In the previous letter, we warned that “shorter-term, we’re certainly due for a bounce, and likely one of the “Rip your face off,” variety.”

Now, once again, short term, we are close to getting a short-term sell signal. The importance of this is that we not only have the major pillars that drive equities looking for a major, MAJOR bear market, but we are also in a period of extreme vulnerability. Therefore, any short-term sell signal must be regarded very, very seriously.

I know there are people arguing that the new economic policies being implemented, the new onshoring of jobs and investments in America are all very bullish, and I certainly agree! Nevertheless, a hurricane is coming, and we’re going to need all the bullish counter-balances we can get going into this one.

In the end, nature wins. And “nature,” as far as the equities markets are concerned, is looking very, very dire, as I have been mentioning for a long time, and especially so now with the yield curve having normalized and our going into a period of extreme vulnerability.

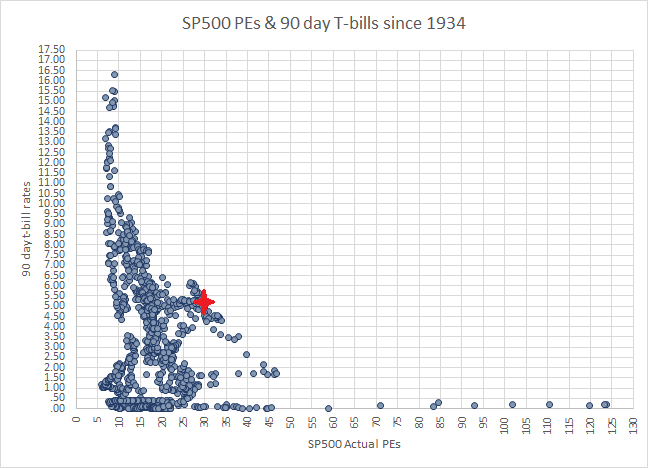

As for the argument of any pickup in forward earnings, as I mentioned last time, at these prices, should forward earnings double, we would be at roughly historically average PE ratios! In fact, at current, existing 90-day rates (which have the highest correlation to equities prices), we are just beyond the outer frontier of what we have seen since T-Bill came about in 1934:

Once again, we are at 12 of the past 20 days in the DJIA having been up, putting us “in the zone” where a nice sell can transpire. Everything is set up for a “Volume Tunnel” system sell, except for a volume bar, which can come an day now.

Looking at the two ETFs that tend to lead the broad market, we find that HYG, the high-yield bond ETF hasn’t hit new all-time-highs, and in fact, its cyclical projection is calling for an interim bottom towards the end of the month:

And SVXY, the inverse volatility ETF, hasn’t come close to new all-time highs either:

I like Vantage Point Software as it readily allows me to see the volume bars in a given market as well as provide the proprietary half-cycle differencing projections into the near future.

Strategy

We wait for a volume bar now to give us the sell signal trigger to act. In the absence of