The Outlook for 2023

A year ago, nearly to the day, witnessed valuation measures which ranged from bubble-era-of-2000 level-proportions to levels even exceeding that, based on the specific measure.

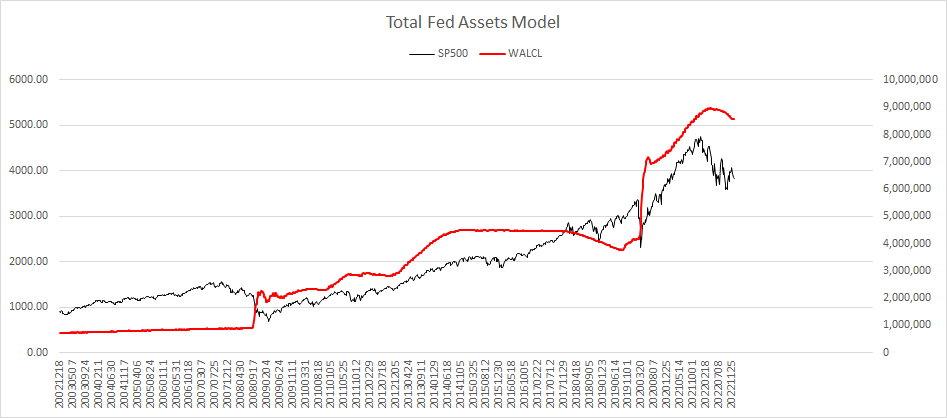

Unquestionably, as is obvious in hindsight but at that moment as well, these were historically obscene valuations, propelled to such lofty levels by Federal officials who were irresponsible (for at least 14 years) in terms of their zero-interest rate policy, flooding of the economic system with money, both in terms of QE and any excuse for more huge Federal Spending. The era will be remembered as one of grotesque irresponsibility at best, and more likely and realistically, of rampant corruption, both in the continual and ever-increasing searches for more pork through spending by elected representatives, and downright insider dealing (what else can we call it) by the likes of former Fed Governors Clarida, Kaplan, Rosengren, current Governor Bostic — and these are the four who have admitted they were dealing for themselves ahead of announcements. What does this say of the others?

These actions were not limited to the United States, but other major economies as well.

For me, in an environment where peace and serenity are the rarest of commodities, the portal to them, for me, is to not say or think, “It’s your fault,” or “It’s their fault.”

They will do what they will do, and if not them, the next corruptocrats who couldn’t care less whether I held them in personal contempt or not. The problem, as far as I am concerned, isn’t with others, as I can’t control a single one, but with me, with how I respond, with how I let such things affect me (or not) The acceptance of this is, as I mentioned, the portal to serenity in a world which is absent serenity.

So I can acknowledge the effects of their irresponsible and downright flagitious actions, without taking offense at it. It gives a distance to it, a lens of better focus for me.

And with that, it’s evident that all of these “puffing” activities from ZIRP to QE created a bubble that fed upon itself. People felt wealthier. That sense fed into a speculative frenzy of truly historical proportions along the lines of the 1920, the Mississippi Land Bubble, the South Seas Bubble. We are witnessing history in the making.

Do you really think history will not remember the tremendous run Bitcoin had, or residential real estate, without regarding the entire era as one of speculative frenzy?

Since the intraday high of 5 January, last year, a point which marks the summit of the wave of speculation that began in 2009 (and other indexes having topped several months before that, including measures of market breadth which too topped early, and including Bitcoin, which topped a few months proper to the Dow), to the intraday low of the 2022, the Dow dropped 22.44%, from intraday peak to intraday low.

22.44%.

Now I would not be surprised if this first week sees a huge upward spike in the indexes to start the year (nor, for that matter, would I be surprised if the Dow gave up 5,000 points in the first week of 2023 either) but I know we have not seen the bottom of this bear market.

But I am not alone - many feel as I do and why shouldn’t they? We have access to essentially the same data and the same historical record for it. And yes, I suppose it is conceivable that the speculative frenzy we witnessed post-March 200, return for another go-round.

But the idea is extremely far-fetched. For that to happen, all those who have been smoked in the ARKs, the PTONs, Zs, and ZMs and on and on, are willing to come back and get their brains beaten out again? This soon? Really?

Or those who have been obliterated in the crypto arena (we dont really hear from them, do we? No more “Ok Boomers?”) come back out for another go-round?

We would have to ignore the fastest interest rate rise in history.

We would have to ignore what is going on in residential real estate, which is in a seizure at the moment. In fact we have to ignore the entire notion of a negative wealth effect.

We would have to accept that a bubble of once-in-a-century-if-that proportions ends without any serious liquidity issues whatsoever?

Oh, than that an index that, historically has seen a 50 - 89% drop coming off of similar valuations tops at not even 22 1/2% this time because why?

“Tech?”

“Innovation!?”

“The wisdom of the Fed, or their new triple-and-quadruple mandates?”

“Stimulus?”

And if stimulus were the answer, if it was that easy, why wasn’t that being done since the fifth century? Are we, collectively, that slow on the uptake that it took that long to figure it out?

No, this is a monstrous bubble, in all assets, that has just started to unravel, we’ve only seen the first salvo. The fact that this hasn’t given it up (truthfully, I would have expected this thing to have collapsed at least two years ago), that it is only now, rolling over, seemingly in slow motion, has created a complacency among the investing public that is blinding them to the bigger picture, which is utterly ominous, and, viewed in the historical lens, will have been so obvious in hindsight.

I dont know what is going to happen here near term. By my calculations, we should be in the midst of a very rapid, serious selloff, that should take us below the lows of 2022, and may well serve as the low point of 2023. This would fit the long term cyclic patters of 242.x months in market lows and the 87 month cycle of liquidity spasms. That is, my cyclical calculations say we should be seeing it in the next week or two, a major drop, a veritable liquidity air pocket, creating a point which would be the low point of the year (a point which thereafter should frustrate both bull and bear).

My gut, however, after spending the second half of December with the market’s daily action all taking steps all within the same footprint, tells me we’re going to see an early head fake, the market shoots up the first week, then the grinding, nascent bear market continues, these past cycles, now having succumbed to a kind of post-covid entropy.